Accounting and Bookkeeping Contract Advice for Businesses

Looking for an accounting contract template to use for your business? We’ve got a template ready to be customized for your needs today.

Download Template

If you are an accountant who provides accounting and/or bookkeeping services, you may be looking for a customizable accounting contract template. If so, we have just what you need. Our accounting contract template can be tailored to fit your specific needs.

Important Considerations for Your Accounting and Bookkeeping Contract

Below We’ll Cover:

- Important Details to Include in Your Accounting and Bookkeeping Contract

- Clauses to Consider Adding

- Mistakes to Avoid

- Links to Additional Resources

- How to Get Your Contract Signed

Important Details to Include in Your Accounting Contract

Accurate bookkeeping and financial records are crucial to the success of any business endeavor. As such, clients may depend on your accounting skills and experience to provide a clear picture of profits and losses, as well as when paying taxes, applying for loans, or meeting with investors. A clear and concise contract offers protection for both you and your clients when agreeing to provide accounting or bookkeeping services.

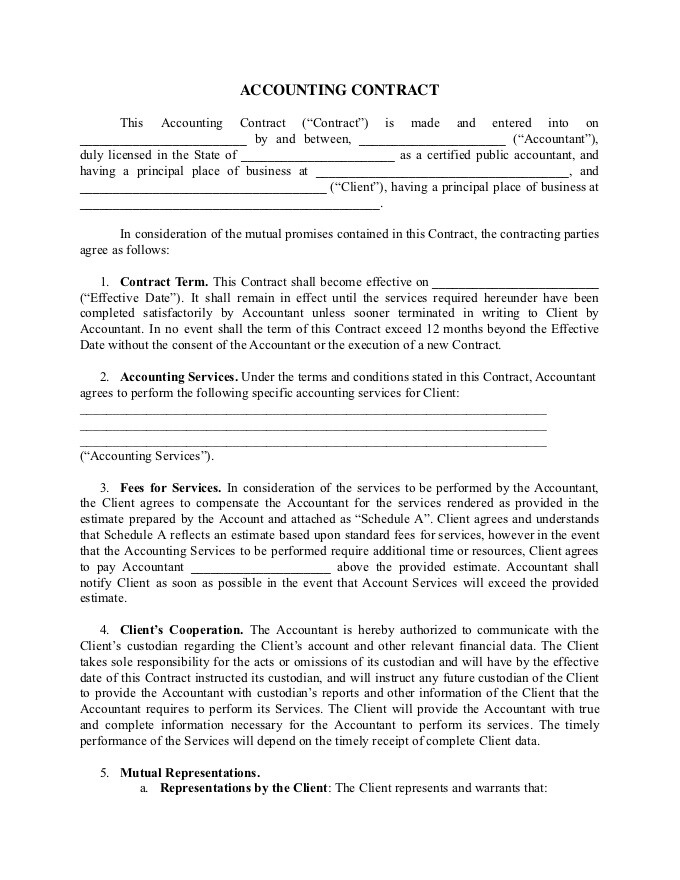

When creating your accounting and bookkeeping contract, be sure to include the following details:

- Identifying information for both parties

- Effective date and contract term

- Description of services to be performed

- Fees

- Representations

- Confidentiality clause

- Termination conditions

- Legal terms

- Signatures

Clauses to Consider Adding

A basic accounting and bookkeeping contract should include the details mentioned above; however, you may wish to include additional provisions in your contract. For example, you may decide to include:

- Ongoing Services Clause. If you provide ongoing services for the business, such as payroll or monthly ledger reconciliation, you may wish to include a clause outlining the terms for ongoing services to ensure that the scope of your duties and responsibilities is clear.

- Exclusion Clause. There may be specific duties or responsibilities that you have not agreed to undertake as part of your service agreement. For example, if you have not agreed to communicate with tax authorities on behalf of the client, the contract should make this clear.

- Contract Deadline. Adding a contract acceptance deadline ensures that the details relied upon when discussing the terms of the contract remain relevant and accurate at the time the contract is executed. You can use Nitro Sign to get any of your contracts or important documents signed quickly and easily!

Mistakes to Avoid

As an accountant, you will undoubtedly play an integral role in the financial health and ultimate success of your client’s business. Disputes that arise surrounding the terms of the agreement between you and your client could lead to costly litigation for both parties. Given the importance of an accounting or bookkeeping contract, care should be taken to avoid making mistakes when drafting the contract, such as:

- Lacking details regarding services to be performed. Accounting and bookkeeping are highly specialized services. Failing to be specific about the services you will, and will not, perform can lead to uncertainty. Be sure to provide a clear description of the expectations both parties have regarding the services to be provided.

- Not addressing how records are to be delivered and/or stored. Accounting records are frequently needed months, even years, down the road. To ensure that your client has access to those records when needed in an acceptable format, be sure to specify in the contract how and where records are to be stored, the length of time they are to be stored, and which party is responsible for storing them.

- Failing to be clear on billing terms. Because an accounting contract can cover services limited to a specific job or can be ongoing, it is important to clarify not just what the fee is for those services, but also how and when the fees are to be paid.

Links to Additional Resources

- Bookkeeping Contracts: Everything You Need to Know

- 10 Steps to Create a Simple and Effective Client Contract

- Construction Accounting 101: A Basic Guide for Contractors

How to Get Your Contract Signed

Proper execution of any contract is crucial to ensuring that the terms agreed upon in the contract will hold up in court should a dispute arise. In today’s digital world, the ability to have your contract signed electronically is imperative. Once you have customized your accounting and bookkeeping contract to reflect the agreement reached between you and your accountant or bookkeeper, sending it for a signature is easy and quick with Nitro. Start your Nitro free trial today.